What you get with our Tech

Automated Client Onboarding

Grapple has digitised the onboarding

process to remove friction for new and

existing clients through automation and

smart integrations.

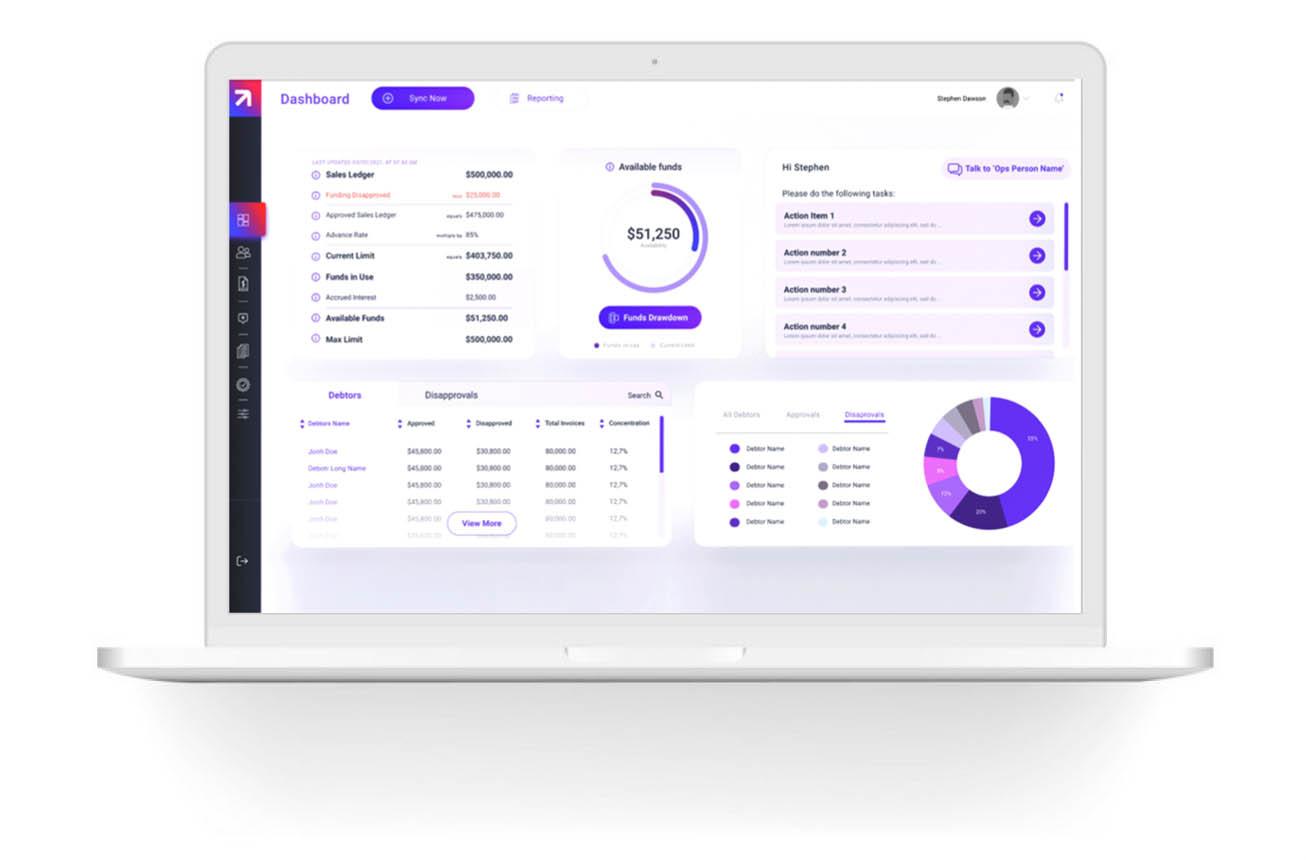

Simple Ledger Management

Customise your facility and client

management settings to suit your business

whilst reducing servicing and administration time.

Preventative Risk Management

Grapple provides the very latest

technology to provide all the information

your business needs – concentration limits

and % (client/debtor and invoice level), live

credit feeds, ledger and payment analysis –

to ensure you see problems before the occur.

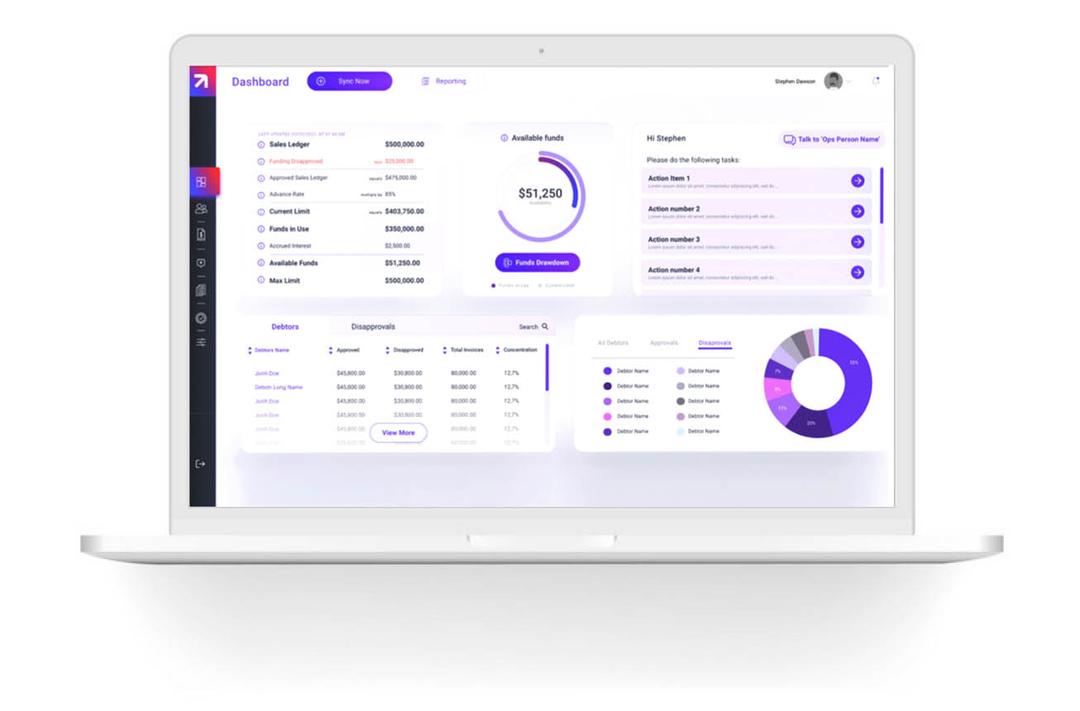

Why Aussie SMEs love our tech

Simple and transparent

With Grapple you know what you get.

Access your working dashboard instantly.

All the information you need to improve your

cashflow and increase working capital is at your fingertips.

Syncs to your invoicing software

Live data transfer with your existing

software saves you time and money.

Financing the way it should be

Our tech makes the approval and

funding process seamless. Verification

and funding is done in minutes.

Why our Partners love our tech

BETTER CREDIT DECISIONS

Grapple’s technology includes live credit

feeds, KYC processes, live bank

statements, accounting ratio analysis

and more which contribute to ensuring we

we see problems before they occur.

DE-RISK THE BUSINESSES YOU FUND

Grapple provides the very latest tech

and best-in-class third party integrations

to de-risk your invoice financing offering and the businesses you fund.

MANAGE NEW AND EXISTING CLIENTS BETTER

Grapple has simplified the onboarding and client management process through automation to reduce servicing and admin.

‘Plug And Play’ Invoice Finance Solution

Grapple’s ‘ready-made’ invoice financing solution is perfect for new market entrants or those looking to gain a footprint into the SME lending industry without having to set up the entire structure and team. With ‘Plug and Play’ all client and platform servicing is executed by Grapple’s team of specialists on your behalf.

Grapple Licensed Tech

The licensing option is for a larger lender who has a funding, credit and operational team in place and most importantly the internal ‘know how’ of operationalising invoice financing at scale. Platform servicing and operations will need to be resourced by your business whilst Grapple provides a custom platform environment for you to use with ongoing tech and training support.

Partnership Approach

Perfect for large lenders or banks who want to keep the customer experience in ‘one spot’ and completely integrate Grapple’s tech into their current solutions and offerings. Work with our specialists to build a UX that compliments your existing product suite and infrastructure. Consider this a ‘blank canvas’ for us to tailor a solution that works for you and your business.